By Gibran Naiyyar Peshimam and Asif Shahzad

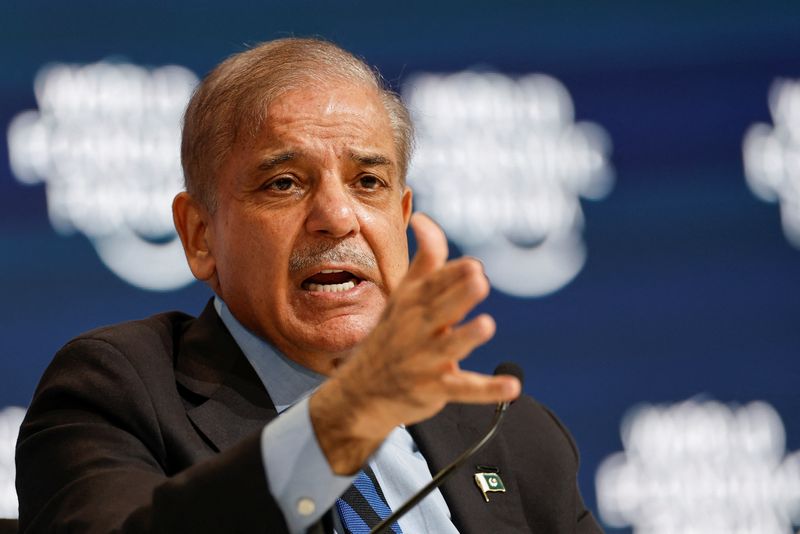

ISLAMABAD (Reuters) -The disbursement of $1.1 billion by the International Monetary Fund (IMF) will help Pakistan achieve greater economic stability, Prime Minister Shehbaz Sharif said on Tuesday, amid discussions for a new loan programme.

The funding was the second and final tranche of Pakistan's $3 billion standby arrangement with the IMF which it secured last summer to help avert a sovereign default.

"The disbursement will bring more economic stability in Pakistan," Sharif said in a statement from his office, adding that the standby arrangement was important in saving the South Asian nation from defaulting on its external liabilities.

Pakistan central bank said in a statement that it has received SDR 828 million (around US$ 1.1 billion) from the IMF in its account.

The IMF's executive board approved the final tranche on Monday.

The approval came a day after Sharif discussed a new loan programme with IMF Managing Director Kristalina Georgieva on the sidelines of the World Economic Forum in Riyadh.

The IMF appreciated Pakistan's policy and fiscal measures to achieve the targets under the standby arrangement.

"Macroeconomic conditions have improved over the course of the program," it said in a statement, adding that 2% growth was expected in the current fiscal year ending on June 30, given continued recovery in the second half.

It said the fiscal position continued to strengthen with a primary surplus of 1.8 percent of GDP achieved in the first half of the fiscal year, on track to achieve primary surplus of 0.4% of GDP.

Islamabad is seeking a new, larger long-term Extended Fund Facility (EFF) agreement with the IMF.

Pakistan's Finance Minister Muhammad Aurangzeb has said Islamabad could secure a staff-level agreement on the new programme by early July.

Islamabad says it is seeking a loan over at least three years to help achieve macroeconomic stability and execute long-overdue and painful structural reforms.

Aurangzeb has declined to give details on the amount the country is seeking.

Islamabad is yet to make a formal request, but the Fund and the government are already in discussions.

If secured, it would be Pakistan's 24th IMF bailout.

The $350 billion economy faces a chronic balance of payments crisis, with nearly $24 billion to repay in debt and interest over the next fiscal year - three-time more than its central bank's foreign currency reserves.

Pakistan's finance ministry expects the economy to grow by 2.6% in the fiscal year ending in June, while average inflation for the year is projected to stand at 24%, down from 29.2% in the previous fiscal year.

The IMF said inflation, while still elevated, continued to decline, and with appropriately tight, data-driven monetary policy maintained, was expected to reach around 20% by end-June.

To move Pakistan from stabilization to a strong and sustainable recovery, authorities need to continue their policy and reform efforts, it added.